Private equity investment firms have been slammed for their role in the declining healthcare quality and access, as well as the rising costs for patients, in a recently released report from the Department of Health and Human Services (HHS).

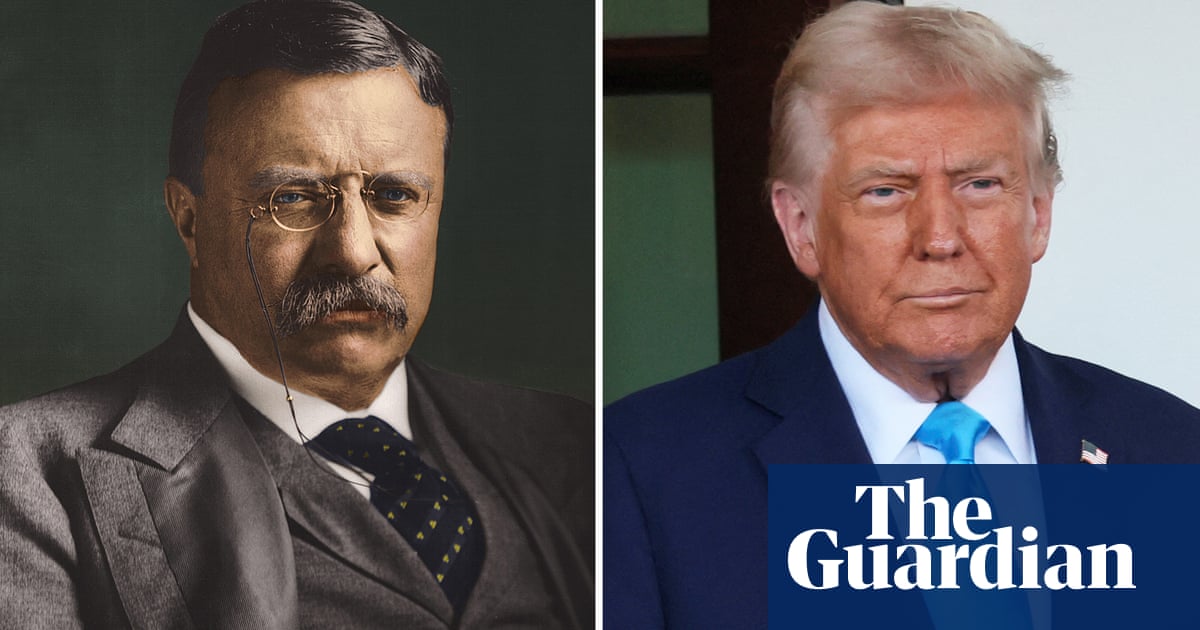

Market consolidation and private equity investment can have deadly consequences in the healthcare industry, says the report, which dropped mere days before Donald Trump retook the Oval Office.

Private equity investment in nursing homes led to an 11% increase in patient deaths, according to one study cited in the report, while another study cited illuminated that insufficient competition in the healthcare market increases the death rate for heart attack patients.

These problems stemmed in part from “aggressive staffing cuts and hiring inadequately credentialed staff”.

One commenter in the report, a physician, said that after her practice was acquired by private equity, she “was forced to see 45 patients daily with 1 medical assistant. This was unsafe … I was routinely told by patients they called with problems and never heard back … I knew that I was going to be the one to go down when something bad happened and I left because I refused to take that fall.”

The report was part of the Biden administration’s “all government approach to promoting competition”, says Hannah Garden-Monheit, who was the Federal Trade Commission’s director of the office of policy planning under Biden. HHS, the FTC and the justice department all worked together on the effort.

Notably, as of early February, a news release about the report appears to have been removed from HHS’s website as a part of the Trump administration’s recent purge of federal health websites.

Private equity firms investing in healthcare often reduce market competition and create local monopolies through the practice of “roll-ups” or “buying up a bunch of practices that compete with each other,” Garden-Moneheit explained, adding: “When you reduce competition, that creates space to raise prices and cut wages.” Private equity firms that create hospital chains through roll-ups of independent hospitals will often credit themselves with “rescuing” or “saving” hospitals.

But public comments on private equity health investments in the report show these so-called rescue missions are deeply flawed.

“We were actually all kind of surprised at the volume of outpouring that we got,” Garden-Monheit said.

The comments were negative, according to the report, which said: “Perhaps the most consistent comments were those expressing frustration with private equity-led acquisitions in health care.”

Garden-Monheit said that of the commenters, healthcare workers within the system were most aware of private equity’s impact. For patients, it can be hard to tell when a facility is acquired by private equity.

“[Private equity investors] don’t announce that they’ve acquired something. They often keep the old name of the firm. They’re like a brain virus or a cancer inside the body of this new firm. It doesn’t announce itself until it gets very late,” said Martin Kenney, senior project director at the Berkeley Roundtable on the International Economy and author of Private Equity and the Demise of the Local.

The workers, on the other hand “become aware because they’ve got new management. They have to do more work. Professionals are laid off, and sub-professionals take over. Instead of a doctor, now you have a nurse practitioner, a physician’s assistant,” Kenney added.

HHS’s report also found that private equity-backed firms frequently replace credentialed workers with less qualified workers. One commenter, a physical therapy assistant, said that her private equity-owned hospital cut costs by giving more hours to unlicensed techs, and fewer to licensed therapists and physicians, but dressed unlicensed workers in the same scrubs as licensed workers.

“This is intentional fraud because patients, families and doctors think [the unlicensed techs] are licensed,” she said. When she tried to voice this concern, she was “threatened with a HIPAA violation for not following the chain of command”, according to the report.

For patients who want to find out if their healthcare facilities have been acquired by private equity, Garden-Monheit says that HHS has been working to change disclosure and documentation requirements so that more information is publicly available, but that “it’s a work in progress”.

And documentation can only go so far to solve the problem, because in some places, private equity has already taken over certain healthcare industries, leaving no other options.

“It’s not like you’re shopping around before you go to the emergency room,” she added. Emergency departments are also a primary target for private equity.

Toward the end of the Biden administration, the FTC had started going after private equity firms for anti-competitive behavior in the healthcare system.

“Thanks to the efforts of the now prior administration, we had actually seen private equity interest in healthcare start to decline,” Garden-Moneheit said.

But she’s unsure whether that progress will continue.

“It’ll be really important to see what the new administration’s approach is,” Garden-Moneheit said, adding she’s concerned they will favor moneyed interests.

“It’s possible we’ll see a private equity bonanza that’s really dangerous for patients.”

German (DE)

German (DE)  English (US)

English (US)  Spanish (ES)

Spanish (ES)  French (FR)

French (FR)  Hindi (IN)

Hindi (IN)  Italian (IT)

Italian (IT)  Russian (RU)

Russian (RU)  3 hours ago

3 hours ago

Comments